As you can see on your enclosed Performance Monitor, 2020 was certainly a good year for our wealth…if not so much for our health. As the market plunged day after day to a loss of 35% in March1, who would’ve imagined it would melt up to the level it is today. 2020 is a stark illustration of why we need to be disciplined in our investment approach and maintain a long-term view. In addition to positive portfolio performance, our team has much to be grateful for.

Catherine

Though we all miss being in the office with our co-workers, this pandemic has allowed Catherine and her husband Mark to spend more time at the lake. As you can see from the picture on the first page, she has no complaints about the view from her “office”.

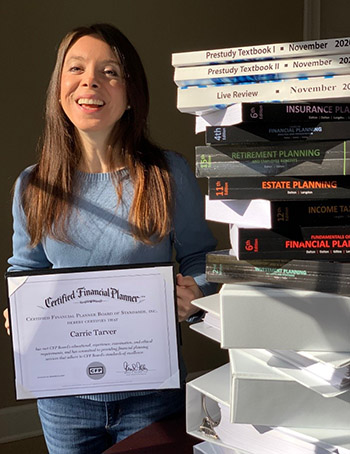

Carrie

The quarantine gave Carrie extra time to study for her Certified Financial Planning (CFP®) certification. Though she was almost “over her head” in study materials, she is grateful to God for giving her grace to pass the 6-hour exam in November.

Malcolm

Malcolm is grateful to have a profession he enjoys and the ability to continue running the business from home. As it turns out, working from home isn’t bad at all. He has lost 7-8 pounds eating more of Judy’s salads…and no Philly Cheese Steaks from the building cafeteria. However, when the pandemic improves, he looks forward to some more Philly Cheese Steaks…and Judy looks forward to cooking less :)

Winning the Race

We now view the Coronavirus correction of last spring as a sharp blip in the midst of one continuing long-term secular bull market. However, in hindsight, some view it as the shortest bear market in history and believe what we enjoyed the past nine months is the beginning of a new secular bull market.1 As is the case in a marathon, as runners move past the first leg of the race, the field of leaders begins to narrow and distance themselves from the laggards. We believe the 2021 lap of this bull market will be similar…, i.e. we will need to be more narrowly focused on the “winning” economic sectors and even more so on the right individual securities. We will also need to carefully manage taxable portfolios even more tax-efficiently with the possibility of higher capital gains taxes.

Though I would not be surprised to see a market correction at any time, below are a few reasons my long-term outlook remains positive and we once again recommend “staying the course”:

Time Not Timing

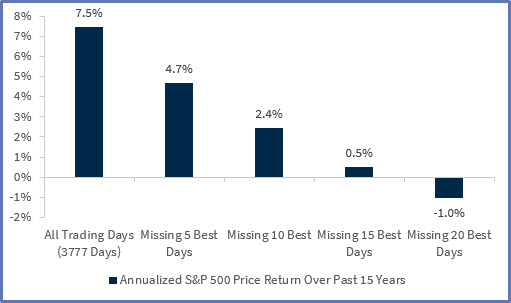

Since most believe we are due a short-term correction, some may ask about the wisdom of raising cash. However, the chart below4 illustrates the dramatic difference in results if one misses even five of the market’s best days. Because of this and the low probability of both getting out and getting back in at the right time, we recommend staying fully invested with an asset allocation that fits your risk tolerance.

May you have a joyous, blessed and fruitful 2021. We covet your prayers for knowledge and understanding in making wise investment decisions. Thank you for your prayers and your trust. We love you and appreciate you.

Malcolm C. Tarver, III

Senior Vice President, Investments

Certified Investment Management Analyst ®

1MarketSmith Charts, Investor’s Business Daily

2Larry Adam, Raymond James, January 11, 2021

3Phil Orlando, Federated Hermes, January 2021

4Raymond James, Investment Strategy: Fact Set, 12 31/20

Any opinions are those of Malcolm Tarver and not necessarily those of Raymond James. The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee that it is accurate or complete. Expressions of opinion are as of this date and are subject to change without notice. Investing involves risk and you may incur a profit or loss regardless of strategy selected. Indices are not available for direct investment. Any investor who attempts to mimic the performance of an index would incur fees and expenses which would reduce returns. The Dow Jones Industrial Average (DJIA), commonly known as “The Dow” is an index representing 30 stock of companies maintained and reviewed by the editors of the Wall Street Journal. Past performance is not indicative of future results. There is no assurance these trends will continue or that forecasts mentioned will occur. The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor's results will vary. Dividends are not guaranteed and must be authorized by the company's board of directors.