What the fixed income market is offering

- 05.22.23

- Markets & Investing

- Commentary

Doug Drabik, Drew O’Neil and Rob Tayloe discusses fixed income market conditions and offers insight for bond investors.

Over the last eight months, the Fixed Income Solutions group has been working closely with financial advisors, clients and prospects with strategies and opportunities to add or increase fixed income allocations to their portfolios. Soaring interest rates and a lifeless equity market triggered waves of interest. The attention to this part of an investment portfolio’s allocation is as welcome as it is essential for the health of an investor’s financial position. But the truth of the matter is that fixed income is and should be an equally important portfolio allocation in a 1% or 10% rate environment, in a soaring or plummeting stock market setting or in an inflationary or deflationary period. This longstanding message bears repeating:

Extreme markets can incite excessive responses from investors. Don’t fall into that trap. Regardless of market conditions, we advocate certain portfolio standards for conservative investors, not the least of which is preserving appropriate asset allocation. Thinking long-term, as opposed to reacting to the moment, can promote the increased likelihood of achieving financial goals. -- Doug Drabik, Senior Strategist

We are experiencing headline volatility paired with market volatility. Yet our message is persistent: invest with long-term purpose and maintain discipline with asset allocation. There is no substitute for the right combination of growth assets (equity, MLPs, insurance, etc.) and principal preserving assets (fixed income). The Fixed Income Solutions group partners with the firm’s traders to deliver ideas tailored for each situation, provides education and customizes services for fixed income needs. Inflation, inverted curves, recession and the Fed are among the prevailing headline topics. This report not only addresses the dominant issues but most importantly discusses how they affect fixed income strategic planning. Take what the fixed income market offers within your own personal goals.

Going… Going… NOT Gone!

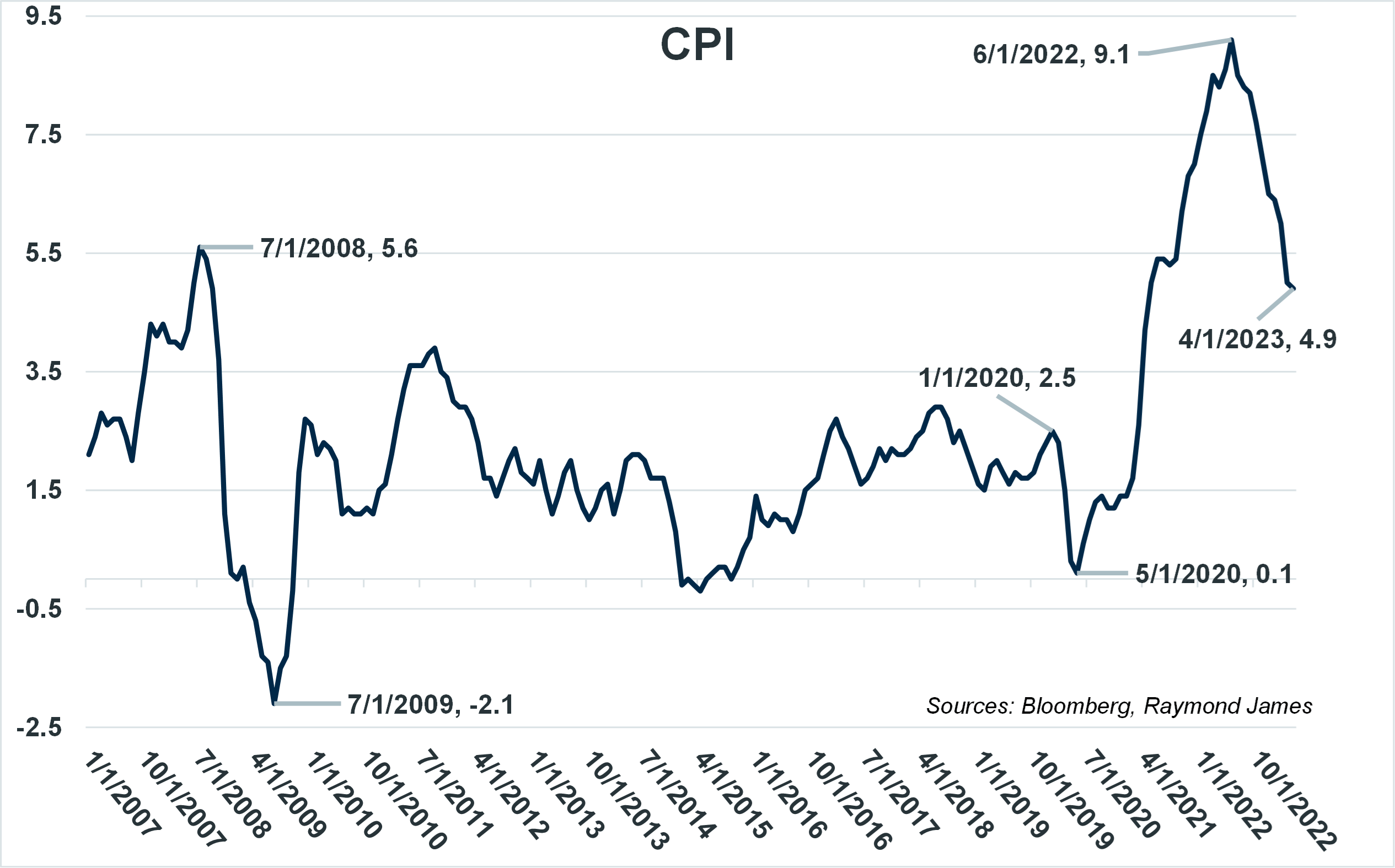

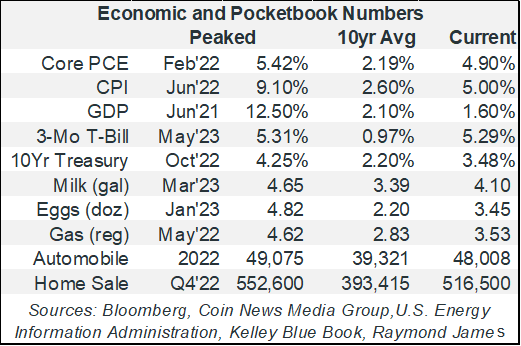

Inflation continues to be the foremost topic. Before the Great Recession, in early 2008, a flash of inflation emerged when crude oil prices rose sharply and uncertainty occurred. By the middle of 2008, commodity prices collapsed and the global financial crisis hit in September. By June 2009, inflation fell to -1.4%. COVID sparked a whole new global inflationary period. This time, despite early “transitory inflation” mantra, inflation anchored firmly and forcefully. It has affected most of us in one way or another be it at the gas pump, the grocery store or with large consumer items such as auto or home purchases.

The Consumer Price Index (CPI) rapidly rose from December 2020 and peaked at 9.1% in June 2022. The Fed has pushed a stunning defense by raising Fed Funds rates by a total of 500 basis points (bp) in 10 consecutive FOMC meetings over a very short 17-month time span. Still, CPI hovers at 4.9%, a distance from the target 2.0% level. There are multiple contributing factors to this inflation although arguably, there are a few that monetary policy might not be able to influence. The supply chain is completely outside of the Fed’s control. It has improved in many areas but remains tenaciously difficult in others. Also, sudden, significant and ongoing labor costs may continue to negatively impact business prosperity.

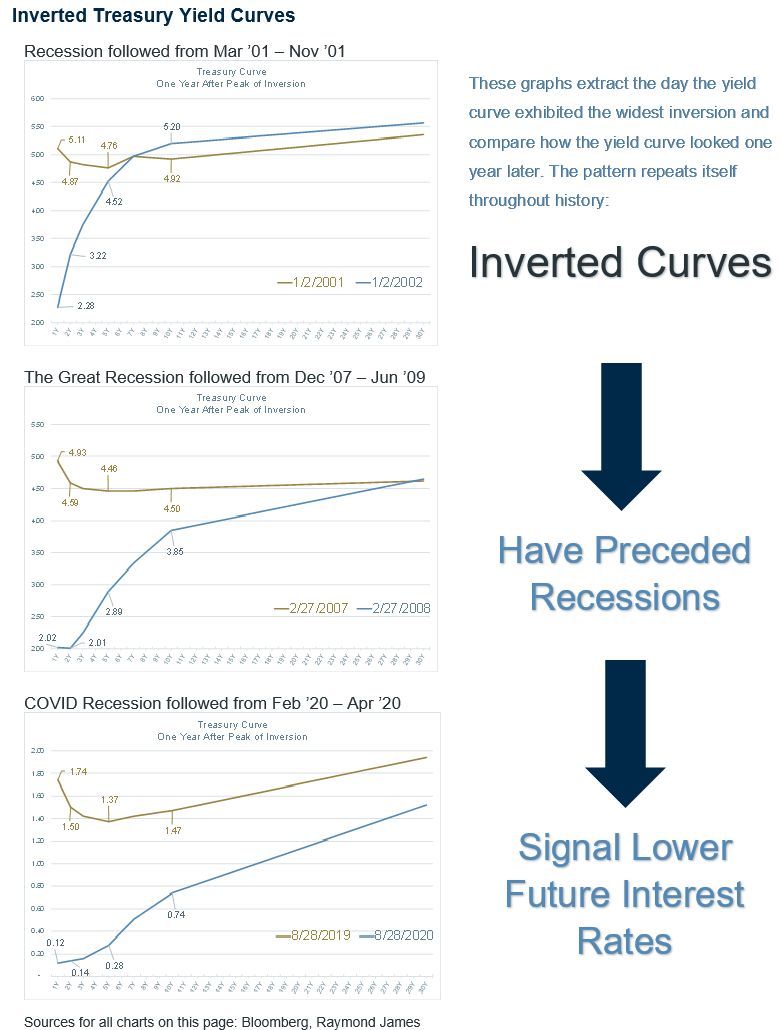

Throughout this inflationary period, several consequences have ensued. The most notable consequence is the banking turmoil. Several banks have collapsed albeit in each case so far, extenuating circumstances have pushed their demise. The stress on the banking sector has created enough market commotion to suggest that the Fed has ended its rate hike cycle and is not only likely to stop raising rates but that they are likely to cut interest rates by as many as four times by January 2024 (according to Bloomberg estimates based on where Fed Funds futures trade).

While the bond market has a historic track record of impressively forecasting with much accuracy, the Fed has been both transparent and genuine in announcing their intentions. In the most recent FOMC meeting, their language softened enough to leave future hikes to be evaluated on a meeting-by-meeting basis; however, they have given no indication of reversing policy as quickly as the Fed Funds futures market seems to be forecasting. The economy has been surprisingly resilient throughout this inflationary period as consumers (which comprise ~70% of GDP) continue to spend on goods and more on services. This economic strength provides the Fed with the flexibility to persist in their quest to drop inflation by raising, not lowering, the Fed Funds rate. Inflation is directionally going, going down – but it is not gone.

The author of this material is a Trader in the Fixed Income Department of Raymond James & Associates (RJA), and is not an Analyst. Any opinions expressed may differ from opinions expressed by other departments of RJA, including our Equity Research Department, and are subject to change without notice. The data and information contained herein was obtained from sources considered to be reliable, but RJA does not guarantee its accuracy and/or completeness. Neither the information nor any opinions expressed constitute a solicitation for the purchase or sale of any security referred to herein. This material may include analysis of sectors, securities and/or derivatives that RJA may have positions, long or short, held proprietarily. RJA or its affiliates may execute transactions which may not be consistent with the report’s conclusions. RJA may also have performed investment banking services for the issuers of such securities. Investors should discuss the risks inherent in bonds with their Raymond James Financial Advisor. Risks include, but are not limited to, changes in interest rates, liquidity, credit quality, volatility, and duration. Past performance is no assurance of future results.

Investment products are: not deposits, not FDIC/NCUA insured, not insured by any government agency, not bank guaranteed, subject to risk and may lose value.

To learn more about the risks and rewards of investing in fixed income, access the Financial Industry Regulatory Authority’s website at finra.org/investors/learn-to-invest/types-investments/bonds and the Municipal Securities Rulemaking Board’s (MSRB) Electronic Municipal Market Access System (EMMA) at emma.msrb.org.

The author of this material is a Trader in the Fixed Income Department of Raymond James & Associates (RJA), and is not an Analyst. Any opinions expressed may differ from opinions expressed by other departments of RJA, including our Equity Research Department, and are subject to change without notice. The data and information contained herein was obtained from sources considered to be reliable, but RJA does not guarantee its accuracy and/or completeness. Neither the information nor any opinions expressed constitute a solicitation for the purchase or sale of any security referred to herein. This material may include analysis of sectors, securities and/or derivatives that RJA may have positions, long or short, held proprietarily. RJA or its affiliates may execute transactions which may not be consistent with the report’s conclusions. RJA may also have performed investment banking services for the issuers of such securities. Investors should discuss the risks inherent in bonds with their Raymond James Financial Advisor. Risks include, but are not limited to, changes in interest rates, liquidity, credit quality, volatility, and duration. Past performance is no assurance of future results.

Investment products are: not deposits, not FDIC/NCUA insured, not insured by any government agency, not bank guaranteed, subject to risk and may lose value.

To learn more about the risks and rewards of investing in fixed income, access the Financial Industry Regulatory Authority’s website at finra.org/investors/learn-to-invest/types-investments/bonds and the Municipal Securities Rulemaking Board’s (MSRB) Electronic Municipal Market Access System (EMMA) at emma.msrb.org.