Winter 2020 Quarterly Commentary

Dear Clients and Friends,

We hope everyone had a wonderful holiday and Happy New Year! We feel it’s a great time to review our expectations for 2020 and recap 2019…

For the year ending 2019, both the bond and stock markets’ performances were overwhelmingly positive. The overarching themes for 2019 were mixed such as trade tensions, an accommodative federal reserve, a slowdown in global manufacturing, presidential impeachment, interest rates falling, and sector rotation as value stocks began to pick up momentum. These tugs and pulls of market headlines moved the markets up and down throughout the year. In the end, an accommodative federal reserve (looser monetary policy), slow growth (but no recession), and phase I of China trade deal were the positive catalysts the market needed to propel forward.

The S&P finished 2019 up 30.43%, the NYSE Composite up over 25.51%, International stocks MSCI EAFA over 22.01%, and the Barclays Bond Aggregate up 8.06%. With most major asset classes up investors certainly had reason to cheer for 2019!

Technology, Communications, and Financials led the way, while Utilities, Health Care, and Energy sectors underperformed in 2019.

Market Outlook

From last quarter:

“While some economic indicators have weakened in the last few months, our outlook is for slow growth, but not a recession. The Federal Reserve reduced interest rates by .25% in July and future reductions are expected. An accommodative Federal Reserve coupled with slower global growth has lowered interest rates and sparked a bond rally. Looser monetary policy is helping counter act the potential effects of the Chinese trade dispute/tariffs. No trade agreement is imminent, but a potential resolution could create a significant rally in global stock markets.”

For 2020, we are expecting global economic conditions to gradually improve. This should reaccelerate earnings growth to 5.5% (only 1.2% for 2019). The market is currently sitting at an all time high, so we feel some of the good news is already priced in. However, since 1929 whenever the market experiences returns in excess of 20%, the following year has averaged 7.38%. Our base case for the S&P 500 returns will fall between 6% to 7%. We believe with the federal reserve still accommodative, trade wars on hold, jobs and consumer spending still strong, and the global environment improving, additional market gains could continue. Therefore, it will be important to buy on market pullbacks as they develop in 2020 to maximize gains.

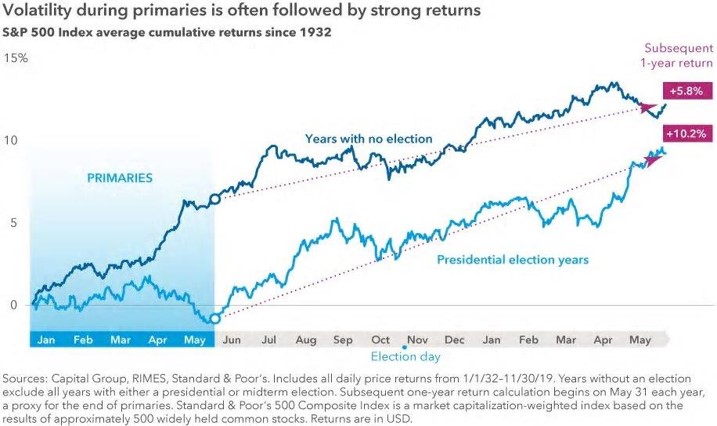

Many clients have asked about the presidential election year and market returns. Though we expect additional volatility in 2020, as the chart below reflects, returns during presidential election years have been positive averaging 10.2% since 1932.

Secure Act

Congress recently passed the Setting Every Community up for Retirement Enhancement Act of 2019 (the Secure Act). Most changes go into effect in 2020 and many rules might affect our clients. We have highlighted a few points below. We plan to discuss this law in more detail during our annual reviews. We will discuss options that could mitigate or enhance retirement opportunities based on the law and each client’s individual situation.

- Repeals maximum age for traditional IRA contributions - Can contribute past 70 ½

- Required minimum distributions age raised from 70 ½ to 72

- Partial elimination of stretch IRAs - now 10 year maximum

- 529 educational expansion - can pay back student loan debt up to $10,000

- Penalty free retirement plan withdrawal for expenses related to the birth or adoption of a child, up to $5,000

Please click HERE to download the 11 Key Financial Planning Takeaways of the SECURE Act.

Research

Iris attended the invitation-only 2019 GS Professional Investors Forum in November in New York City, where she heard from top industry analysts and economists.

Pictured is Iris with attendees at the Women’s Networking Reception prior to the conference kick-off (2nd row behind woman in green)

The Team

Scott, George, and Paul (client) climbed 9 miles to the 3,284’ summit of Old Rag mountain. We had a beautiful day to hike. Thank you Paul for hiking with us. We hope to get back up there in 2020!

Pictured L to R is Paul, George, and Scott

George had a chance to take a Segway tour of Yorktown. Thank you, Randy and Jill (clients and owners of Yorktown Patriot Tours). We plan to bring the team out in the late spring for a tour and maybe pub visit afterwards.

Pictured L to R is Randy and George

Scott enjoyed a day fishing on the York River and Bay on board a client, Tom’s new dream boat… While the fish weren’t biting a fun day was had by all.

George and Iris visited client’s, John and Susie, who are executive directors for the Colonial Seaport Foundation. This foundation is currently building a working replica of an 18th century coastal trading ship. The Luna will be used for education, classroom lectures, and possible field trips for children.

Pictured L to R is John, Susie, and George on board the Luna. She is scheduled for completion late 2020.

Iris became the proud great aunt of beautiful Maybelline Grace, who is also the 1st great grandchild for Iris’ parents!

Bodie made the cover of Legacy Financial Groups 2019 Christmas card. In case you were wondering, he made sure the Grinch delivered all the presents and Bodie also got to enjoy a little roast beast.

New Legacy Member

Lucy has recently joined our team of pets. She is a 14-week-old Aussie Doodle and is jointly owned by Shannon and George. We look forward to making many new memories with her at the office… though we are still waiting for Bodie to play with her! It appears he prefers being a solo practitioner in the office ambassador role!

January Trivia

We actually have two trivia items for the quarter. The first one comes from a client who posed this question to Scott, Iris, and George during a client event. Thanks to Alex for keeping us on our toes.

Question:

How much do pet owners spend on Halloween costumes for their pets?

Answer:

According to the National Retail Federation pet owners spent $490 million dollars to provide the very best costumes and attire!

Since we are just started 2020, we thought we would share the top 5 New Years resolutions. Please keep in mind these are just resolutions. According to U.S. News & World Reports 80% of New Year’s resolutions are broken during the same year!

Top 5

- Diet or eat healthier

- Exercise More

- Lose Weight

- Save More and Spend Less

- Learn New Skill or Hobby

We have listed a link to the most recent quarterly market data for your review. Raymond James’ Capital Markets Review reflects current market and economic conditions. You can access the report by clicking on the link http://www.raymondjames.com/pdfs/capital_markets_review.pdf.

Thank you for your interest and as always please do not hesitate to contact us if you have any questions or comments.

The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market. The Dow Jones Industrial Average (DJIA), commonly known as “The Dow” is an index representing 30 stock of companies maintained and reviewed by the editors of the Wall Street Journal. The MSCI is an index of stocks compiled by Morgan Stanley Capital International. The index consists of more than 1,000 companies in 22 developed markets. The Bloomberg Barclays US Aggregate Bond Index is a broad-based flagship benchmark that measures the investment grade, US dollar-denominated, fixed-rate taxable bond market. Sector investments are companies engaged in business related to a specific sector. They are subject to fierce competition and their products and services may be subject to rapid obsolescence. There are additional risks associated with investing in an individual sector, including limited diversification. There is an inverse relationship between interest rate movements and bond prices. Generally, when interest rates rise, bond prices fall and when interest rates fall, bond prices generally rise. Investing involves risk and you may incur a profit or loss regardless of strategy selected.

Any opinions are those of W Scott Mowry, Iris C Porush, and George A Wright, Jr., and not necessarily those of Raymond James. Expressions of opinion are as of this date and are subject to change without notice. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Investing involves risk and you may incur a profit or loss regardless of strategy selected. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor’s results will vary. Past performance does not guarantee future results. Future investment performance cannot be guaranteed, investment yields will fluctuate with market conditions.