The 3 questions cash managers should be asking

What can I do better?

After a decade of anemic short-term yields, it may be time for you to shift from the status quo. What can you be doing better with cash management today?

With the Fed on a path to interest rate normalization, it may be time to actively reevaluate your liquidity management. Cash investors (i.e., corporate operating cash, family office liquidity, municipalities) may have an opportunity to increase yield and spread at the front end of the yield curve. This trend may even accelerate if the Federal Reserve continues its hiking path.

Where are the opportunities?

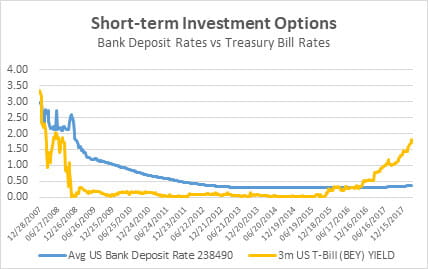

What are we seeing to support this view? Generally, as a cash investor, you likely rely on bank deposits and/or the money markets (U.S. Treasury bills, money market funds, commercial paper, etc.) for short-term investment needs. Yields on these products tend to move in longer-term cycles with bank deposits providing a yield benefit in periods of falling interest rates and money market products out-yielding in rising rate environments. The relationship between these alternatives ebbs and flows over time as shown in the graph.

During the financial crisis, you may have taken advantage of a temporary period of unlimited FDIC insurance coverage for deposits and parked all cash in bank deposit accounts. You’re not alone. Even though this period of unlimited coverage expired on December 31, 2012, few alternative investment options provided enough benefit over simply letting money sit in deposit accounts. So, many cash investors let their funds sit idle. Those days are over!

As interest rates ebb and flow various products tend to offer the best return based on the current cycle.

Source: S&P Global Market Intelligence

The Federal Reserve has increased short-term interest rates 6 times since 2015. Yet, bank deposit rates have barely moved. Significant opportunity exists to increase returns by exploring cash-alternative investments with U.S. Treasury Bills offering 143 basis point advantage over the U.S. average bank deposit rate for the first time since 2007.

What could that mean to you?

Today, your company’s $5mm to $7mm in operating capital could realize $100,000 incremental annual revenue by capturing some of the returns lost through bank inefficiencies.

Don’t have the bandwidth for a deeper dive or think it’s not worth the hassle? Maybe you’re like many of our clients who don’t have internal resources to evaluate cash flows and cash investment. You can rely on banks to continue to earn wide spreads on your cash. You can rely on us to mine opportunity for you as we have been doing for decades with institutions like yours. We’ll do the heavy lifting and let you focus on your core business.

We are known in our industry because we bring our proprietary cash management process, seasoned experience and the unparalleled power of Raymond James in the search for solutions. Let’s answer these questions together. Our team is available to assess your situation and find ways to help you do better.

U.S. government bonds and treasury bills are guaranteed by the U.S. government and, if held to maturity, offer a fixed rate of return and guaranteed principal value. U.S. government bonds are issued and guaranteed as to the timely payment of principal and interest by the federal government. Treasury bills are certificates reflecting short-term (less than one year) obligations of the U.S. government. There is an inverse relationship between interest rate movements and bond prices. Generally, when interest rates rise, bond prices fall and when interest rates fall, bond prices rise. A basis point is a unit that is equal to 1/100th of 1%, and is used to denote the change in a financial instrument.

Views expressed are not necessarily those of Raymond James & Associates and are subject to change without notice. Information contained herein was received from sources believed to be reliable, but accuracy is not guaranteed. Information provided is general in nature, and is not a complete statement of all information necessary for making an investment decision, and is not a recommendation or a solicitation to buy or sell any security. Past performance is not indicative of future results. There is no assurance these trends will continue or that forecasts mentioned will occur. Investing always involves risk and you may incur a profit or loss. No investment strategy can guarantee success.