Paul Jesinskis, CFP®

Financial Advisor

“In the midst of chaos, there is also opportunity.” ~ Sun Tzu

Prologue

Stock prices often shift for complex reasons, and while we create stories to explain these changes, recent events remind us how unpredictable markets can be. Political developments and economic fears have reshaped investor sentiment, challenging traditional narratives.

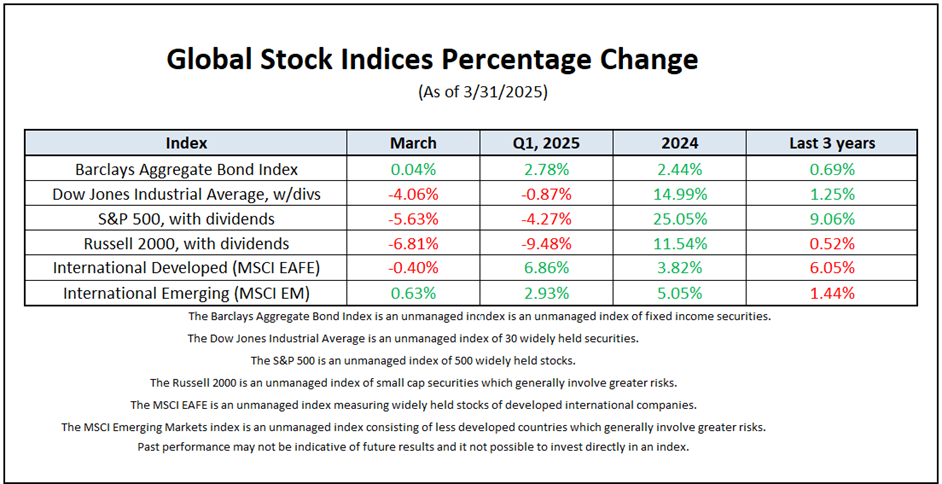

So far in 2025 markets in Canada, Mexico, Europe, and China are outperforming the S&P 500, while US technology stocks are lagging. Investors are shifting toward safer sectors like healthcare and consumer staples amid uncertainty – a common strategy during volatile times.

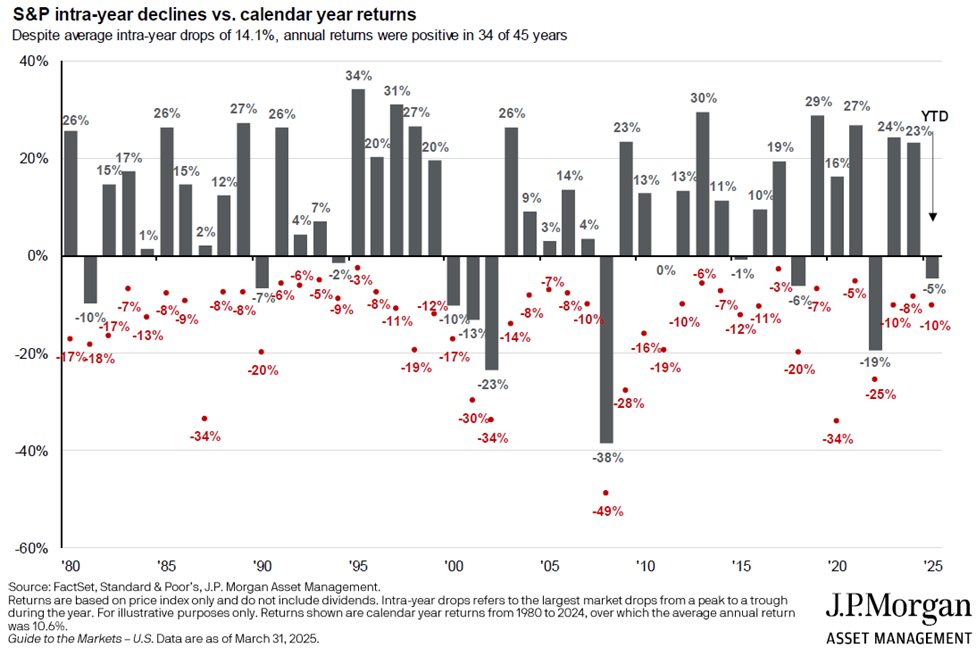

Though short-term emotions often drive markets, history shows that intra-year declines are typical, and annual returns tend to end positively, see Chart of the Month. Price fluctuations may seem dramatic, but business fundamentals rarely change as quickly. Disciplined investors can use this volatility to uncover long-term opportunities.

As market stories continue to unfold, the benefit of diversification becomes crystal clear. A wide-ranging portfolio spreads risk, captures opportunity across sectors and regions, and steadies returns through the ups and downs. While the prominence of U.S. markets may face challenges, the financial landscape ahead promises complexity, requiring adaptability and resilience from investors. Diversification remains a cornerstone of prudent investment management, essential for navigating the uncertainties of financial markets.

Please reach out with questions.

-Paul

Noteworthy links:

- RJ: Investment Strategy Quarterly

- RJ: Questions linger following latest tariff announcement

- Marko Papic: Trump Has Popped the Bubble of American Exceptionalism

Chart of the Month

Navigating Volatility: S&P 500's Resilience Amid Double-Digit Declines

Article of the Month

Four Thoughts

By Jonathan Clements, March 1st 2025

WHEN I STARTED writing about personal finance in the late 1980s, my focus was on giving “actionable” money advice. Here, at the end of my career, I’m more interested in offering thoughts that’ll help folks with all areas of their life, financial and otherwise.

I’m not sure how many articles I have left in me. Fingers crossed, it’ll be many more than my current diagnosis suggests. But whatever the case, here are four thoughts that I’d like readers to remember:

- Worry less. As I eye the exit, my mind keeps coming back to the same notion: I hope folks can find a way to spend less time fretting, and not just about their finances.

We are, alas, hardwired to worry. That’s how our hunter-gatherer ancestors were able to survive countless dangers and reproduce, thus ensuring we’re here today. But constant worry isn’t necessary for survival anymore. Instead, it’s often a waste of time, one that mostly serves to make us unhappy.

Want to fret less? Start by pondering what stresses you out. Is there a way to address your fears? Often, when it comes to money, the path to less worrying involves simplifying our finances, keeping a healthy cash reserve, settling on the right stock-bond mix, making sure we diversify broadly, limiting debt, buying the right insurance, getting our financial affairs organized and listening less to market pundits.

Sometimes, our anxiety is the result of our own procrastination. We might dillydally over buying life insurance or getting a will drawn up. Sometimes, we’re worrying about issues over which we have no control, and what we need is some level of acceptance.

The unfortunate reality is, we’ll never stop worrying. But perhaps we can at least deal with our big fears, so our stress level isn’t quite so high, and sweat less over the small stuff. No, it doesn’t much matter whether we rebalance every year or every two years, or whether we have 75% in stocks rather than 70%, or whether our credit card pays 2% cash back on restaurant spending instead of 1.5%.

- Talk it through. So much nonsense could be avoided by discussing the issues that estrange us from others, rather than assuming we know what they’re thinking. We might imagine that folks are out to cause us harm. But often, the reason for their apparently unkind behavior has nothing to do with us and everything to do with some misfortune in their life about which we have no clue.

Similarly, we can save a lot of time by asking about the matters that puzzle us, rather than worrying that our questions will lead others to view us as ignorant. I’ve sat through countless meetings where someone finally confesses, “Sorry, I don’t understand….” At that point, a majority of participants then admit that they too are confused.

- Think for yourself. When folks raise their voice and pound the table, we sit up and take notice. Perhaps we shouldn’t. I’ve found that the loudest folks often least understand the issue at hand. Instead, they’re noisily trying to justify their own choices, about which they aren’t all that confident.

We also shouldn’t allow ourselves to be bullied into action by popular opinion, whether it’s reflected in the words of neighbors, colleagues or market pundits. In addition, we shouldn’t let ourselves be swayed by stock and bond prices, believing the pattern we see in market prices offers some message about the future. Got a sensible, low-cost, diversified portfolio? It’s important to stand our ground, even as those around us flit from one investment to another.

When folks offer seemingly sensible advice, keep in mind that there’s more than one way up the mountain. Personal finance is indeed personal. What makes sense for others may not make sense for you—because you have a different financial situation and different emotional makeup. Yes, we can learn a lot from others, but we shouldn’t necessarily mimic their actions. My advice: Listen when others tell you what they themselves have done. But don’t listen when they tell you what you ought to be doing.

- Understand what’s influencing you. We aren’t just swayed by those around us, by the media, by advertising and by recent market returns. We’re also influenced by the past—the good and bad experiences that shape our fears and values.

What are the situations we seek to avoid? How do we like to spend our time? Why do we use our money in the way that we do? Events in our past—perhaps involving our parents or our schooling—likely bear heavily on our behavior today, even if we no longer remember many of those incidents.

Still, it’s worth getting a good handle on our values and fears. For instance, I hate the sense that I’m under attack, I loathe pretense and boasting, and it can ruin my day if I know a bad meal awaits me. All this I can trace to my time at English boarding school.

Perhaps nothing is more important in managing money, and in how we conduct ourselves more generally, than knowing ourselves. No, you’ll never totally get there. I know I haven’t. But the more we understand about ourselves, the better we can cope with our fears—and the more we can create a life where we’re truly happy.

Here is a link to the full article: Four Thoughts

*Raymond James & Associates, Inc, member New York Stock Exchange/SIPC

*The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material, and is not a recommendation. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct.

*Views expressed are the current opinion of the author, but not necessarily those of Raymond James. The author’s opinions and forward looking statements expressed are subject to change without notice. This information does not constitute a solicitation or an offer to buy or sell any security. Information contained in this report was received from sources believed to be reliable, but accuracy is not guaranteed.

*There is no assurance any investment strategy will be successful. Investing involves risk and you may incur a profit or loss regardless of strategy selected, including diversification and asset allocation. Past performance may not be indicative of future results. International investing involves additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets. Small- and mid-cap securities generally involve greater risks and are not suitable for all investors. Asset allocation and diversification do not guarantee a profit nor protect against a loss. Individual investor’s results will vary.

*Gross Domestic Product (GDP) is the annual market value of all goods and services produced domestically by the U.S. Past performances are not indicative of future results. Investing always involves risk and you may incur a profit or loss. No investment strategy can guarantee success.

*This information contains forward-looking statements about various economic trends and strategies. You are cautioned that such forward-looking statements are subject to significant business, economic and competitive uncertainties and actual results could be materially different. There are no guarantees associated with any forecast and the opinions stated here are subject to change at any time and are the opinion of the individual strategist. Data comes from the following sources: Census Bureau, Bureau of Labor Statistics, Bureau of Economic Analysis, the Federal Reserve Board, and Haver Analytics. Data is taken from sources generally believed to be reliable but no guarantee is given to its accuracy.

*Links are being provided for information purposes only. Raymond James is not affiliated with and does not endorse, authorize, or sponsor any of the listed websites or their respective sponsors. Raymond James is not responsible for the content of any web site or the collection or use of information regarding any web site’s users and or/members.

*Certified Financial Planner Board of Standards Inc. owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™ and Federally registered CFP (with flame design) in the U.S., which it awards to individuals who successfully complete CFP Board’s Initial and ongoing certification requirements.

*The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market.

*To opt out of receiving future emails from us, please reply to this email with the word “Unsubscribe” in the subject line. The information contained within this commercial email has been obtained from sources considered reliable, but we do not guarantee the foregoing material is accurate or complete.

Insights & Discovery