The Covid-19 crisis has been analogized to the current generation’s equivalent of a Pearl Harbor and world war. The surprise nature and stresses of the virus compared to Pearl Harbor are real. The shared experience for us as human beings and citizens of the United States is bona fide. And the shared sacrifices, though relative among us, that will be required to patch up the costs of this crisis are certainly being born today and in the years to come.

“Let us make future generations remember us as proved ancestors just as, today, we remember our forefathers.” Roo Moo-hyun

A current read is Ron Chernow’s ‘Washington, A Life.’ There are many parallels in this book to our current circumstances. It profiles leadership in the country and in specific men who left indelible marks in history, both good and bad. It highlights the risks of health issues as an everyday part of life. Then it was the ever-present small pox, dysentery, diphtheria and others; today our battle against Covid-19. And it starkly lays out the sacrifices that were paid for the ideas of liberty and a new form of democratic government. Then in a battle for freedom. Today in a battle to protect the physical well-being of our citizens and the prosperity we have come to enjoy.

Sacrifice – the act of giving something you want in order to get something else or to help someone else.

Sacrifices are an integral part of history. From its infancy the Revolutionary War was fought over 8 and 1/2 years by a country and militia that was poorly financed, trained and equipped; whose combatant was one of the world’s most sophisticated and well trained adversaries.

In the Civil War fought over 5 years, the enemy was within. We fought our own neighbors, using our own resources and destroying our own assets in the most casually stricken war in our history; estimates of 700,000+/- deaths.

World War I was one of the globe’s deadliest conflicts. Fought over 4+ years, it is estimated that there were 9 million combatant deaths, 7 million civilian deaths and tens of millions of deaths from further genocides and the 1918 Spanish Flu pandemic. A horrifically bleak period in human history.

World War II was fought over 6 years from 1939 to 1945 (US involvement from 12/1941). It was the worst blood-stained mark on the history of mankind. Estimates are casualties of 70-85 million people which represented approximately 3% of the globes population. Germany and the Soviet Union lost upwards of an estimated 9% and 14% of their respective total population at that time! Approximately 2/3 of the deaths were military and civilian deaths directly due to war and 1/3 resulting from disease and famine. American casualties are estimated at 420,000.

The vast majority of industrialized nations used all their human, financial, business and scientific capabilities in the WW II effort. The US government spent $350 billion ($4 trillion adjusted for inflation) for the war effort, or twice as much as it had spent in the entire history of the country up to that point! In the last year of the war it spent 40% of GDP on the conflict. Ironically, the inflation adjusted price of the US costs of WW II is approximately equal to the first stimulus package in the Covid-19 crisis.

In 1942, Franklin Roosevelt asked each citizen for an "equality of sacrifice" -- each doing their part to assist the nation. As men were dying in combat, he said in a fireside chat, "there is one front and one battle where everyone in the United States -- every man, woman, and child -- is in action, and will be privileged to remain in action throughout this war. That front is right here at home, in our daily lives, and in our daily tasks. Here at home everyone will have the privilege of making whatever self-denial is necessary..."

The Covid-19 Crisis will evolve with stories of horrid healthcare conditions in many cities. There will be lives lost by essential workers, our frontline and militia against the virus. There will be economic losses suffered by businesses, their owners and employees. There will be loved ones dying alone without family and friends to share and support their final moments. And they will involve the temporary restricting of our liberties to protect ourselves, our family and our communities. Let us be grateful for those taking these risks on our behalf today. And remember the sacrifices of those before us that provided our ability to make our current sacrifices to defeat this current invisible enemy threatening the existence we have come to cherish.

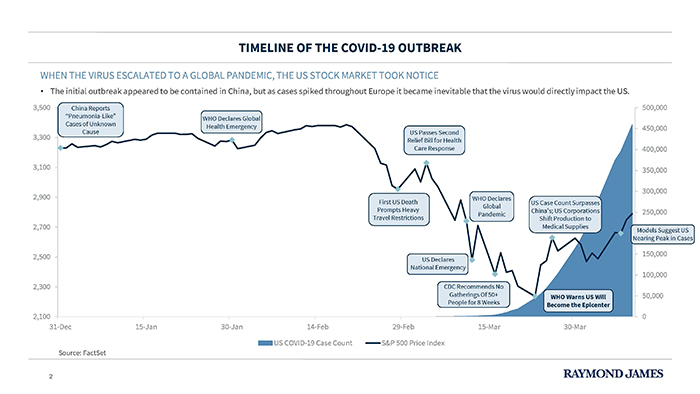

As we described in our last communication, developing perspective on our current circumstances involves continued assessment of several items and the sequential nature of how they will evolve and lead one to the other. The first item is the progress and subsequent management of the Covid-19 virus. Secondly, the government monetary and fiscal response to the management of the virus and the economic damage. Third the financial markets reactions. And fourth, the economic contraction and subsequent recovery. Following is an update on syntax of this crisis.

Covid-19 Progress

A day of unselfish purpose is always a day of confident hope. – Woodrow Wilson

Here is where we stand today (April 13, 2020) in the fight.

- US confirmed cases – 526,400, daily trend is 30,000 new cases

- US deaths – 20,457

- US Tested – 2,817,000

- Though US cases reported is still up in trend, certain large hotspots are beginning to show signs of approaching a flattening of the curve.

- Social distancing continues in most states

- It is commonly accepted that testing and a vaccine are the crucial elements to arresting the current crisis. Serological testing, testing for antibodies and immunity, vaccinations and a treatment to produce an immunity to the disease, have tremendous resources and attention being devoted to their efficacy. Neither are currently approved or available in widespread usage.

It appears that for the near term, social distancing measures will be the primary antidote to the management of the virus.

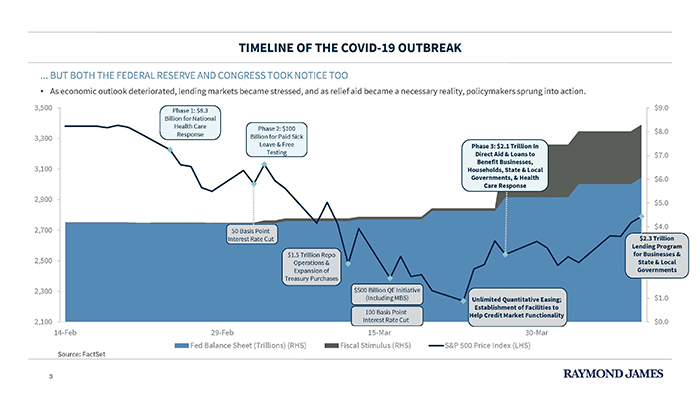

US Government Policy Response

The monetary and fiscal response to the Covid-19 crisis has been unprecedented in its velocity or extent. Measures to date:

- Monetary policy sets interest rates at near 0%

- The Federal Reserve is purchasing securities in credit markets to improve their overall functioning; types of securities have been expanded over the ensuing weeks

- The Fed is assisting with money market fund liquidity through the Money Market Mutual Fund Liquidity Facility (MMLF)

- To encourage bank lending, the Fed is lowering rates it charges to banks to loan to them through the discount window and has temporarily relaxed lending requirements

- The Fed on March 23rd, established two new facilities to support highly rated U.S. corporations. The Primary Market Corporate Credit Facility (PMCCF) allows the Fed to lend directly to corporations by buying new bond issuances and providing loans. Under the new Secondary Market Corporate Credit Facility (SMCCF), the Fed may purchase existing corporate bonds as well as exchange-traded funds investing in investment-grade corporate bonds

- The Fed, on April 9th, announced the Main Street New Loan Facility and the Main Street Expanded Loan Facility; the two programs offer four-year loans to U.S. businesses with up to 10,000 employees or revenues of less than $2.5 billion

- The Fed also announced the Paycheck Protection Program Liquidity Facility that will facilitate loans made under the Small Business Administration’s (SBA) Paycheck Protection Program (PPP). Bank lending to small businesses can borrow from the facility using PPP loans as collateral

- There are additional lending facilities that have been created for state and local municipalities and to provide liquidity for the municipal bond market

- Congress has approved the $2 trillion CARES Act which among other things provides direct checks to a majority of households, expands unemployment insurance and provides relief to small businesses

- In the Great Financial Crisis the US Fed’s portfolio rose from $800 billion to a peak of $4.5 trillion. By September of 2019, the portfolio was $3.6 trillion. As of April 11, 2020, it has risen to $5.8 trillion

Financial Markets

The financial markets have experienced unprecedented volatility in the wake of the Covid-19 crisis. The markets moves have mirrored the speed and depth of the virus itself.

- YTD the US Treasury 1-year yield has gone from 1.56% to .25%

- YTD the US Treasury 5-year yield has gone from 1.67% to .41%

- YTD the US Treasury 10-year yield has gone from 1.88% to .73%

- From peak to trough the US stock market (S&P 500) was down -34%

- The fastest -30% decline in history

- From peak to trough the Intl stock market (MASCI EAFE) was down 51%

- # of daily price swings of 5% or more in S&P 500 since March 13 – 7

- The average daily price swing of the S&P 500 during the pandemic market – +/-1.70%; only greater for a similar period during the Great Depression

- From closing low of 2237 to April 9 close at 2789 - +25%

Economy

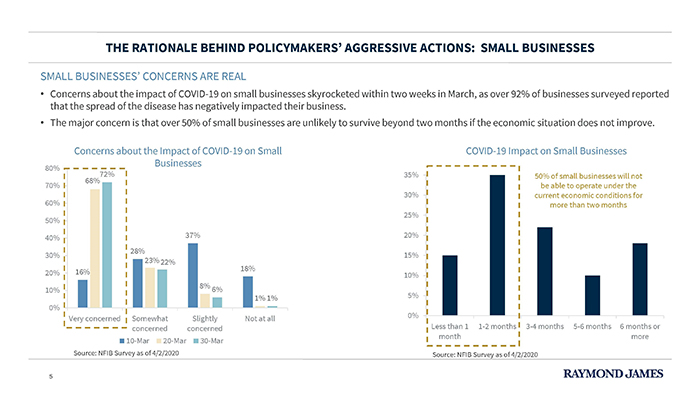

- 17 million people have filed unemployment claims since mid-March; result could be record low unemployment to record high in short time; total estimated workforce 155 million

- Tourism, transportation, entertainment, restaurant and retail represent approximately 20% of GDP and 20% of US payrolls; these are some of the hardest hits industries which have effectively been shut down by social distancing

- These aforementioned industries contributed 7% of operating earnings to the S&P 500 in 2019

- WTI crude price $23.00; 1 month high $28.70; 1 month low $20.09

- Oil producers are in agreement to cut global oil production 10-20%

- Global oil consumption is predicted be down 35%; from 100M barrels a day to 65M

- Consumer confidence has declined sharply

ABE Perspective

Optimism is essential to achievement and is also the foundation of courage and true progress. – Nicholas Murray Butler

How fast have things changed and how fluid are perspectives? Here is a recent example from Goldman Sach’s chief equity strategist.

First, April 7 interview on CNBC, “Risk to the downside is greater than the opportunity to the upside from this point where we stand today.” Goldman Sachs’s chief equity strategist, David Kostin,

“There’s a little bit of asymmetry in terms of the downside risk toward a level in the S&P 500 of around 2,000, which is down almost 25%, and upside of around 10% to a target at the end of the year of 3,000,”

Then, April 13 headline, Goldman Sachs equity strategists David Kostin, says the worst of the market rout is behind us. A “previous near-term downside of 2000 [for the S&P 500] is no longer likely. Our year-end S&P 500 target remains 3000 (+8%),” says the team in a note to clients on Monday.

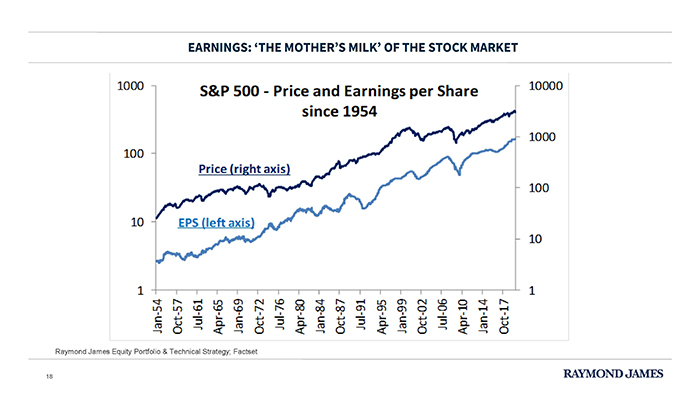

From asymmetrical downside risk to year-end upside of 8% in a week? A week which experienced its best market return since 1974. What changed about the earnings and economic forecasts in the past week to alter this forecast to the upside?

Today, we find ourselves asking questions relative to the virus and the economy similar to the following as we continue to develop a perspective for investing in the current environment?

- When will I feel comfortable going into a crowded restaurant or sporting event?

- When will I be willing to experience air travel in the US or Internationally?

- When will I schedule my next vacation outside the US? To Italy or France?

- When will I be willing to experience public transportation?

- When will we have the ability to test everyone to know whether they have had Covid-19?

- When will we have a vaccine for Covid-19 and be able to vaccinate everyone who needs it?

We have spent a significant amount of time in conference calls with our portfolio managers and reading credible health, political, economic and market thought-leaders from across the globe the last 6 weeks. The context of the Great Virus Crisis has changed significantly with each passing week and the information accordingly. Our perspective has evolved commensurate with the changing circumstances. Here are some of our key takeaways and a summary of our evolving perspective:

- Regarding virus management

- Social distancing is helping to contain the curve

- In the US, we will reach manageable aspects of the virus throughout the country at different points in time as the management is done more at state, county and city levels

- Without increasing immunity, serological testing and a vaccine social behaviors will be altered and economics will not be restored to previous levels. Serological testing may be a 2020 reality. Vaccinations may be a 2021 event.

- Regarding monetary and fiscal responses

- Low interest rates continue to make asset inflation probable, as low interest rates are an unattractive option for income investors

- Short-term, responses have improved liquidity, quieted credit markets and improved equity markets

- Ultimately, short-term, intermediate and long-term, markets will question the costs of this additional debt burden on the US government finances, US taxpayer finances and the US dollar

- Debt is imperative to our individual, corporate and government finances. Without it fewer homes would be purchased, fewer companies financed and fewer government programs financed. In every crisis, the weak are exposed through their lack of liquidity and excessive leverage. We may not yet know the extent as to who the weak are in this crisis and the risks to the economy and markets

- Regarding investment managers and markets

- Trading activity in fund portfolios has been modest. The speed of this crisis has made it difficult to assess specific changes to business and the economy. Activity in most cases has been to upgrade quality in securities where feasible. Regrets of less activity have out-weighed regrets of too much activity.

- For equity managers the goal of the portfolio is to reposition for risk taking when they think they can make more valid estimates of future earnings and assess valuations accordingly. Presently, many companies are suspending earnings guidance or lowering estimates. At the same time many are borrowing more money to provide liquidity in the coming months and years

- Winners will emerge from knowledge based industries and well managed, lower leveraged and global businesses

- For fixed income managers, the goal is to validate credit worthiness of bond issuers and determine if the credit spreads (how much additional return they are getting paid to own one bond over another) reward their risk taking. As weaknesses are exposed more light will shine on these opportunities.

- More volatility may follow the unfolding of the specific business weaknesses and the economic determination of the virus crisis. This volatility can create further opportunities for us to commit capital to attractive asset classes and our recommended managers; while our managers select individual securities perceived to offer attractive returns forward looking

- In general, recessions, bear markets and credit crisis create oversold conditions and the goal for managers is to position more risk capital in the portfolios.

- The economy and the crisis

- Before the virus, and after the Great Financial Crisis, the US economy had grown at a rate just above 2% a year, approximately half the rate of expansions post WW II. Coming into 2020, we have believed a slow growth economy was a continued reality and an inevitable recession could be shallow in economic contraction and duration. We are now experiencing a recession. One that may deeper than earlier estimates and one that may recover more in a U shape than V shape.

- This is a global pandemic and as a consequence is creating a global recession. The virus has not affected all countries at the same time or to the same degree. The consequences, intended and unintended, are yet to be absorbed. Political and economic relationships will be altered for years to come.

- Globalization created a supply chain focused on profits (cheaper) and efficiency (just-in-time). Future supply chains will be balanced between profit and efficiency and durability and resiliency; i.e. the ability to withstand risks of supplies and suppliers and the ability to recover quickly form disruptions. This will result in more broadly diverse supply chains, work forces and potentially increased costs.

Generally in life, as with the markets, it is better to be an optimist than a pessimist. We would say an optimistic realistic may be optimum! As optimists we believe in the ingenuity and resiliency of mankind. We will ultimately manage this virus and others successfully. Business and economies will be repaired and recover.

As realists we know mistakes happen and the improbable happens. The costs of properly planning for this pandemic would have been a fraction of the ultimately costs we may bear. Given more time, the actual economic and business costs will become more apparent. We will do our best to allocate capital at prices and times where risks are manageable and returns attractive.

What we miss most during the last 6 weeks are the physical presence and hugs from our family and friends. Our wish for all of you is a speedy return to those who you cherish the most in your life.

The illustrations used were presented in “COVID-19 Update: Earnings & the Markets” by Lawrence Adam, Raymond James Chief Investment Officer dated 04/13/2020. The full presentation can be found here.

The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any opinions are those of the Abuls, Bone & Eller Group of Raymond James and not necessarily those of Raymond James. Expressions of opinion are as of this date and are subject to change without notice. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Investing involves risk and you may incur a profit or loss regardless of strategy selected. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor's results will vary. Past performance does not guarantee future results. Future investment performance cannot be guaranteed, investment yields will fluctuate with market conditions. The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market. The MSCI EAFE (Europe, Australasia, and Far East) is a free float-adjusted market capitalization index that is designed to measure developed market equity performance, excluding the United States & Canada. The EAFE consists of the country indices of 22 developed nations. Investing in oil involves special risks, including the potential adverse effects of state and federal regulation and may not be suitable for all investors. International investing involves special risks, including currency fluctuations, differing financial accounting standards, and possible political and economic volatility.

Insights & Discovery