“Bull markets are born on pessimism, grow on skepticism, mature on optimism, and die on euphoria.”

~ Sir John Templeton”

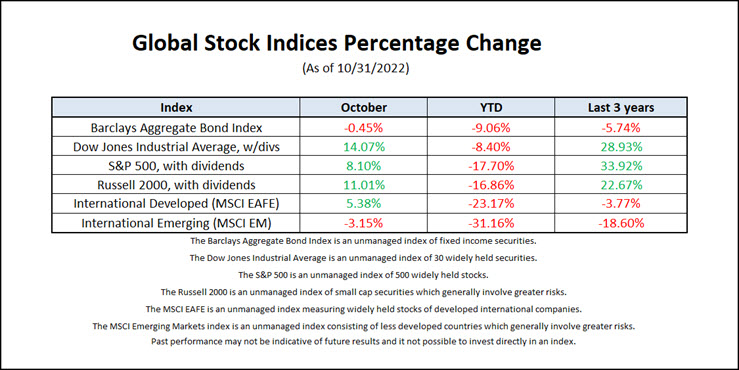

After a torrid September, October saw markets rally as we close in on the final stretch of the year. This last week, the market was looking for a definitive signal from the Fed that they might be near the end of their tightening cycle. We finally heard comments that the Fed remains very data dependent on incoming data to determine future hikes.

“At some point, it will become appropriate to slow the pace of increases as we approach the level of interest rates that will be sufficiently restrictive to bring inflation down to our 2% goal,” Powell said. “There is significant uncertainty around that level of interest rates, even so, we still have some ways to go," Powell added.

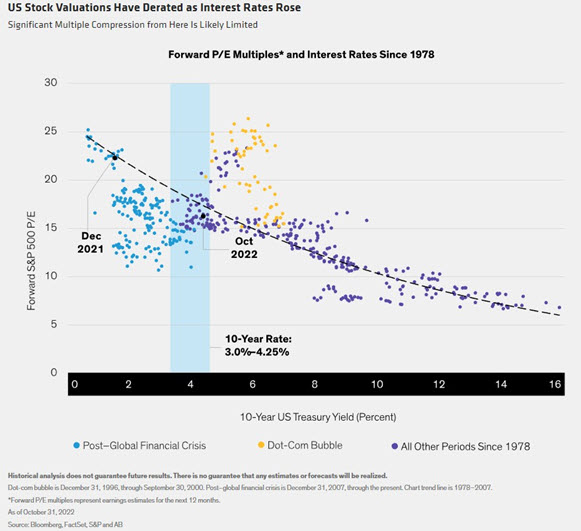

The Fed has raised interest rates by 300 basis points (3%) across its last four meetings, however headline inflation has remained stubbornly high, 7.7% in October. This subtle shift towards more gradual tightening could mean it now favors taming soaring prices over a longer period of time, rather than doing so by triggering a short but sharp recession.

There is no way we’re out of the woods just yet. The possibility of a December 50 basis point rate hike has helped fuel this recent rally, but it doesn’t change the narrative or the thesis. The Fed is going to raise rates into 2023 and, until it stops raising rates and we see a meaningful decline in inflation, we can’t have a sustainable rally. Inflation has not come down enough for the Fed to change tact and maintain their credibility. This process will take time given the lagged impact of the rate hikes and feeding through of data.

There’s no denying the markets are an uncomfortable place to be these days. Market volatility and risk are clearly evident this year. In the enthusiasm of a bull market, it can be hard to see the value of more prudent approaches. These are the moments that make their value clear.

Please reach out with questions.

-Paul

Noteworthy links:

Russell Napier: We will see the return of capital investment on a massive scale

RJ: Review retirement plan contribution limits for 2023

RJ: Social Security increases benefits by 8.7% for 2023

RJ: IRS suspends missed RMD penalty for certain inherited IRAs

Rates and Stocks: How Low Can Valuations Go?

Three Ways You Can Cash In on Cash

By Jason Zweig

Published in WSJ on September 30th, 2022

Keeping a portion of your portfolio safe and liquid no longer means settling for nothing—as long as you’re ready to move your money out of your bank account.

Cash isn’t trash anymore.

With stocks—and just about every other asset—taking a beating this year, even the most aggressive investors can suddenly see the virtue of keeping some money liquid and safe from market turmoil. And, at long last, your cash can earn income you don’t need a microscope to detect.

To do better, though, you’ll have to put your money in motion. Bank accounts have earned next to nothing for nearly a decade and a half

—and still do. With the Federal Reserve jacking up interest rates, the national average yields on savings and money-market accounts at banks have doubled this year—to 0.14%, a level that Greg McBride, chief financial analyst at Bankrate.com, calls “nothing short of pathetic.”

Fortunately, raising the return on your cash is easier than ever. For most investors, the two best choices are money-market mutual funds and U.S. Treasury securities.

For years, money-market funds’ yields have been stuck near zero, and individual investors yanked $43 billion out of such funds last year, according to the Investment Company Institute. In recent months, though, these funds have finally begun to pay more income. The Crane 100 index of the largest money-market funds yielded 2.64% this week, up from only 0.02% in February and 2.01% at the end of August.

“Money-market funds are worth a second look now,” says Harry Sit, who runs a blog called The Finance Buff. “Rather than having to wait for [online banks] Ally or Synchrony or Marcus to adjust their rates on savings accounts or CDs, your money-fund yields can adjust daily with the market.”

Your brokerage firm may force you into its “cash sweep,” an account with an affiliated bank that is likely to pay much lower yields—a measly average of only 0.29% as of Sept. 23, according to Crane Data.

Sweep accounts are designed as a receptacle for the dividend and interest payments your stocks or other investments throw off. All too often, they function like a jail, imprisoning your cash where it earns punitively low returns.

However, you should be able to transfer your cash balance out of any sweep accounts into money-market funds offering much higher income.

This week, more than 380 money-market funds were yielding 2.5% or higher, averaged over the past seven days, according to Crane Data. Many are from such leading firms as Fidelity Investments, Charles Schwab and Vanguard Group.

You can strike an even better deal with Uncle Sam himself.

Inflation-protected savings bonds, called I bonds, are offering a 9.62% annual yield for the following six months to investors who buy before the end of October. The yield for new buyers will change on Nov. 1, depending on the latest update to the inflation rate in October.

You can’t buy more than $10,000 in electronic I bonds per account per year, you must hold for a minimum of one year and you’ll forfeit three months’ interest if you redeem within five years. So I bonds aren’t quite as flexible and liquid as cash.

Uncle Sam is offering a good return on cash, though. The yield on three-month U.S. Treasurys has risen by more than 3.25 percentage points this year, a greater increase in nine months than in any full year on record back to 1981. The one-month Treasury bill yields 2.6%, up from 0.05% at the beginning of 2022.

You can buy T-bills straight from the U.S. government at TreasuryDirect.gov, or through a brokerage firm. TreasuryDirect charges no fees or commissions; most brokers don’t either on new-issue Treasury securities.

Unlike money-market funds, Treasury securities are backed by the full faith and credit of the U.S. government, so they are considered risk free. The income on Treasurys is generally exempt from state and local taxes.

“Nobody advertises Treasurys,” says Mr. Sit of The Finance Buff. “The government doesn’t really have a marketing budget, and the brokers don’t make any money on them. So a lot of people forget you can buy Treasurys direct, or they just don’t know about it.” Those who do know are gleeful, if not giddy, over getting some income on their cash again.

“When we were kids, we all played these games where you accumulate things, like Monopoly,” says Armando Arias, a software engineer in the Bay Area who has been buying six-month Treasury bills twice a month since August on TreasuryDirect. Earning more than 3% on his cash “reminds me of the joy of building up all those hotels on Boardwalk,” he says.

“At [JPMorgan] Chase, I made 10 cents in interest in August—but we earned over 3% [annually] on our Treasurys,” says Eric Lieber, a retired technology manager who lives in the Los Angeles area.

He uses an online tool at Charles Schwab to build a so-called ladder of Treasury securities that mature at constant intervals between one month and one year. “That gives us extra income without having to sell stocks when prices are falling,” Mr. Lieber says.

“You can make your own little money-market fund with Treasury bills,” says Jonathan Kahn, an individual investor in New York who also buys on TreasuryDirect. “You even get check writing, because it’s tied to your bank account. But TreasuryDirect is better and safer [than a money-market fund], with the same utility, and a state and local tax preference.”

Mr. Kahn sticks to one-month T-bills, automatically “rolling” or reinvesting each bill for a total of two years.

With one-year through seven-year Treasurys currently yielding more than maturities of at least 10 years do, you might be tempted to buy nothing but short-term Treasurys.

Interest-rate changes are unpredictable, though. So Dave Culbertson, a former financial manager in the energy industry who lives in the Houston area, has been building a ladder of the highest-yielding Treasury that matures each year between now and 2032.

“If interest rates go up, great,” he says. “If they go down, at least I have some longer-term yields locked in.”

Here is a link to the full article: WSJ – Three Ways You Can Cash In on Cash

*The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material, and is not a recommendation. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct.

*Views expressed are the current opinion of the author, but not necessarily those of Raymond James. The author’s opinions and forward looking statements expressed are subject to change without notice. This information does not constitute a solicitation or an offer to buy or sell any security. Information contained in this report was received from sources believed to be reliable, but accuracy is not guaranteed.

*There is no assurance any investment strategy will be successful. Investing involves risk and you may incur a profit or loss regardless of strategy selected, including diversification and asset allocation. Past performance may not be indicative of future results. International investing involves additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets. Small- and mid-cap securities generally involve greater risks and are not suitable for all investors. Asset allocation and diversification do not guarantee a profit nor protect against a loss. Individual investor’s results will vary.

*Gross Domestic Product (GDP) is the annual market value of all goods and services produced domestically by the U.S. Past performances are not indicative of future results. Investing always involves risk and you may incur a profit or loss. No investment strategy can guarantee success.

*This information contains forward-looking statements about various economic trends and strategies. You are cautioned that such forward-looking statements are subject to significant business, economic and competitive uncertainties and actual results could be materially different. There are no guarantees associated with any forecast and the opinions stated here are subject to change at any time and are the opinion of the individual strategist. Data comes from the following sources: Census Bureau, Bureau of Labor Statistics, Bureau of Economic Analysis, the Federal Reserve Board, and Haver Analytics. Data is taken from sources generally believed to be reliable but no guarantee is given to its accuracy.

*The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market.

Insights & Discovery