What Investors Should Be Thinking

Investors in their 60’s, 70’s, etc.

“I have a financial plan which budgets for temporary down cycles in stocks exactly like this one. And a balanced portfolio, with a sizable portion of my money in bonds…….which don’t really care whether stocks go up or down. I am withdrawing (or plan to be withdrawing) only what I need to live on, leaving the rest of my money in the markets for growth over decades so I can fight my brutally erosive rising cost of living. The daily news is dangerous noise.”

Investors in their 30’s, 40’s, 50’s

“I’m really glad I have a financial plan in place, because it is my financial road map. I need to tolerate the ups and downs of equities because there’s a decent probability that I will live another 40+ years – and bonds & cash haven’t been able to keep pace with the inevitable rising cost of living. And if I am still saving into my portfolio, a down cycle means I get to buy stocks on sale. The daily news is dangerous noise.”

Investing success means being able to tie the $$$ you have now to the expenses you will have in the future in such a way that you can do all the things you want to do.

- Retirement

- Kids through college

- Passing on your estate to those you love

- Gifting to charity

- Starting a business

- Whatever

And being able to do that depends entirely on how you behave when things get ugly, because they always do.

As advisors, our concern is invariably this: Will our clients be able to stay disciplined and not be tricked by news-stoked fear or market-timers when things get rough?

Stick with your investing plan. It's not going to be easy….never is. But that’s why it works.

Nothing kills the long-term returns of a portfolio like throwing away the playbook in the heat of a temporary down cycle in the markets.

Letting fear & news overwhelm you can easily lead to decades of financial destruction on the installment plan.

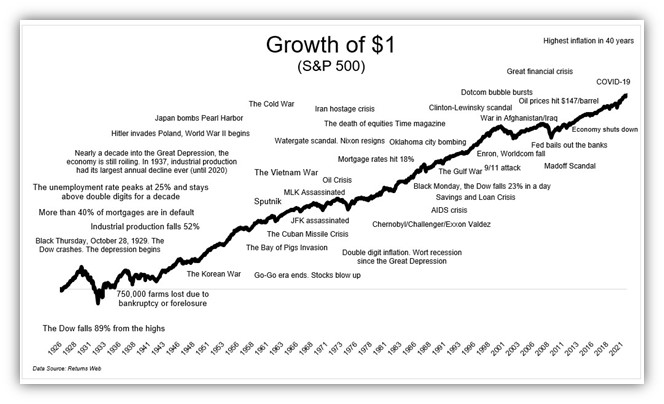

“This time is different” said many people during each of these previous periods…

The views expressed herein are those of the author and do not necessarily reflect the views of Raymond James & Associates or its affiliates. All opinions are subject to change without notice. Neither the information provided nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Past performance is no guarantee of future results. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. Investing involves risk and investors make incur a profit or loss. The Standard & Poor's 500 Index is a market capitalization weighted index of the 500 largest U.S. publicly traded companies by market value. Individuals cannot invest directly in an index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor’s results will vary. The investments listed may not be suitable for all investors. Raymond James & Associates recommends that investors independently evaluate particular investments, and encourages investors to seek the advice of a financial advisor. The appropriateness of a particular investment will depend upon an investor's individual circumstances and objectives.