Trees Don't Grow to the Sky

There’s an old saying on Wall Street which relates to being careful about the price you pay. “Mercedes makes a great car, but would you pay $5 million for one?”

It is essential that an investor think about this when they buy stocks. Foolishly buying a stock at any price dramatically increases your chances of disaster.

During 2020, a crop of boom (and eventually bust) stocks were all over the news for their eye-popping gains. FOMO (Fear Of Missing Out) mania drove lots of novice investors to pour hard-earned cash into these COVID-lockdown darlings. Stocks including Peloton, Zoom, Shopify, Zillow, Roku, Etsy, DraftKings, Okta, Pinterest, Sea Ltd, and Carvana. Many of these companies were not turning profits, yet investors kept on ridiculously over-paying for shares of stock. They were paying $5 million for a bunch of barely running Mercedes.

How did that work out? Massive losses. Here are the losses since the peak in each stock:

Peloton -91%

Zoom -73%

Shopify -70%

Zillow -71%

Roku -74%

Etsy -51%

DraftKings -76%

Okta -65%

Pinterest -68%

Sea, Ltd. -68%

Carvana -84%

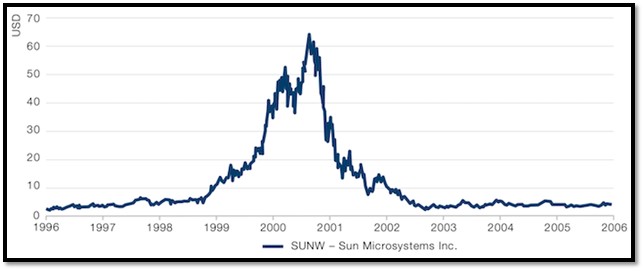

One of the hottest stocks of the late 1990’s technology boom was Sun Microsystems (symbol SUNW). This was actually a big company, and they were turning a sizable profit. But that didn’t stop investors from eventually getting carried away and paying nosebleed-level prices for shares of SUNW stock. Here is a chart of SUNW’s stock price soaring from below $10/share in 1998 to its peak of $64/share in the year 2000 (which equated to “10 times revenues”). Only to then crash back down below $10/share within 2 years. A 90% loss in 2 years.

Source: LPL Financial

In 2002, Scott McNeeley, the CEO of Sun Micorsystems, scolded his investors. This is what he said:

“At 10 times revenues, to give you a 10-year payback, I have to pay you 100% of revenues for 10 straight years in dividends. That assumes I can get that by my shareholders. That assumes I have zero cost of goods sold, which is very hard for a computer company. That assumes zero expenses, which is really hard with 39,000 employees. That assumes I pay no taxes, which is very hard. And that assumes you pay no taxes on your dividends, which is kind of illegal. And that assumes with zero Research & Development for the next 10 years, I can maintain the current revenue run rate. Now, having done that, would any of you like to buy my stock at $64? Do you realize how ridiculous those basic assumptions are? What were you thinking?”

There are many proven methods for trying to determine if a stock is wildly overpriced. You can Google them right now. Sadly, most investors never put in the work or practice discipline, and instead allow their greed and fear emotions to drive their buy and sell decisions.

The views expressed herein are those of the author and do not necessarily reflect the views of Raymond James & Associates or its affiliates. All opinions are subject to change without notice. Neither the information provided nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Past performance is no guarantee of future results.

The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. Investing involves risk and investors make incur a profit or loss.

The investments listed may not be suitable for all investors. Raymond James & Associates recommends that investors independently evaluate particular investments, and encourages investors to seek the advice of a financial advisor. The appropriateness of a particular investment will depend upon an investor's individual circumstances and objectives.