Running is simple. But doing it really fast or really far isn’t easy.

Hitting a golf ball is simple. But hitting it straight and far, shot after shot, isn’t easy.

Shooting a gun is simple. Shooting it at a bird flying fast and in every direction isn’t easy.

Through Rich’s son Jordan’s high school years, he had a fortune cookie taped to the door of his bedroom. It read as follows, “Knowing and not doing, is the same as not knowing at all.”

It was prophetic as most fortune cookies are, and it came in handy as the actions or inactions of a teenager didn’t quite measure up to the expectations of his father and mother!

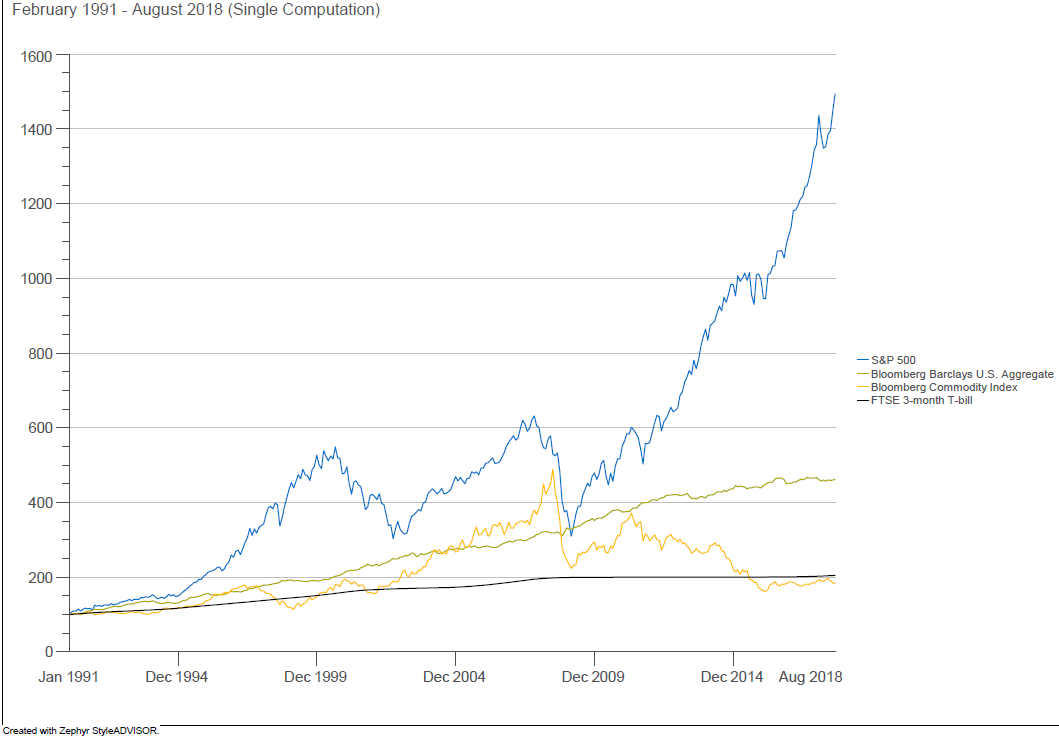

However, it isn’t just the teenagers of the world who fall prey to ‘knowing and not doing’. Below is a long-term chart of the return of the basic asset classes of stocks, bonds, cash and commodities. Any person who has spent any time introduced to these charts knows that in the long-term stocks outperform bonds, bonds outperform commodities and commodities outperform cash. Seems ‘simple’ enough. So why doesn’t every investor just own stocks in their portfolios?

The S&P is comprised of 500 large company stocks and is widely seen to be representative of the U.S. stock market. The Barclays US Aggregate Bond Index is a broad-based flagship benchmark that measures the investment grade, US dollar-denominated, fixed-rate taxable bond market. The Bloomberg Commodity Index tracks the prices of a broad range of diversified commodities. The FTSE 3-month T-Bill index tracks the performance of 3 month US treasury bills. The indices mentioned are unmanaged and cannot be invested into directly. Past performance is no guarantee of future results.

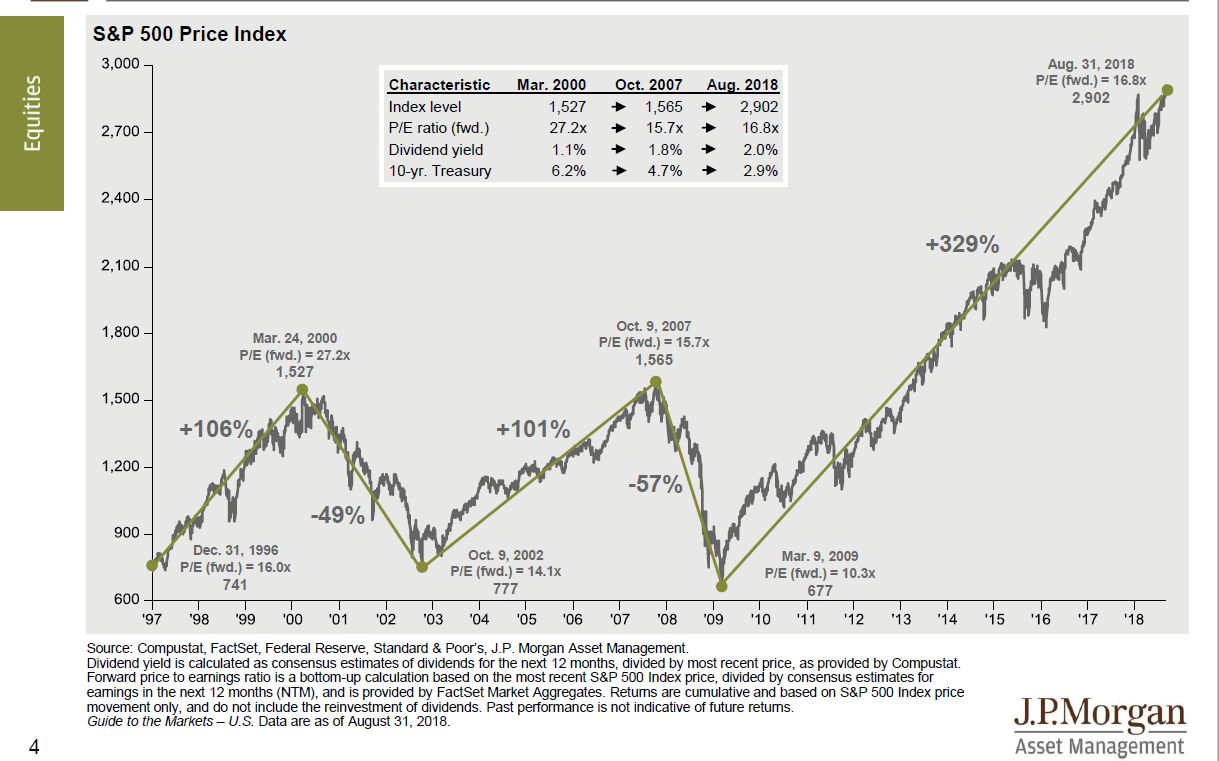

The answer is because of periods like those illustrated below. Stocks can and will go down in value.

Losing money or temporarily losing value in your investments ‘isn’t easy’ for many of the bravest souls. In particular as the values on your statements grow larger and larger, declines in portfolio values may elicit a more significant emotional reaction. These reactions frequently lead to poor decision making; i.e. chasing returns and selling losses.

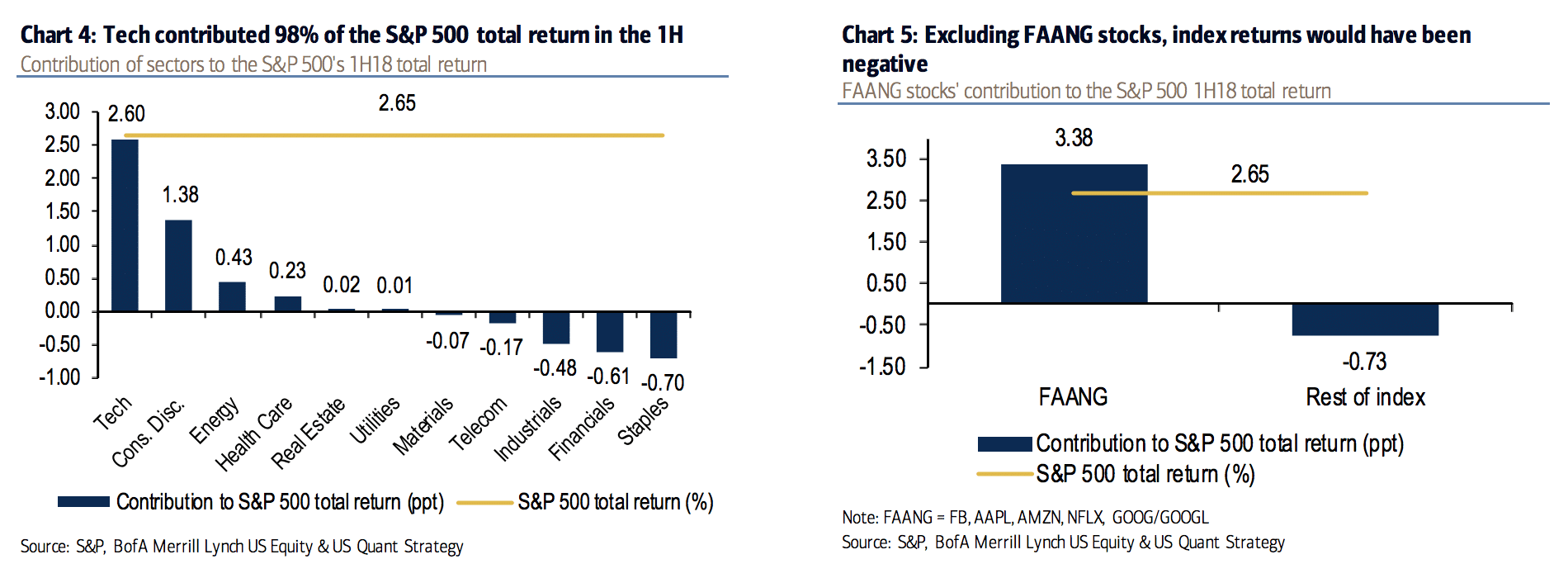

Though less acute but still a behavioral issue in investing, is the fear of missing out (FOMO); i.e. when markets or a particular investment are doing well and you are not doing as well. It isn’t always easy to hear others are doing better than you.

We have gone one of the longest periods in market history with an absence of significant market declines. It has also been a period where the US stock market has outperformed all other asset classes by a wide margin. Further within the US stock market, there has been a concentration of performance in the growth asset class, the technology sector and the FAANG stocks (Facebook, Amazon, Alphabet, Netflix, Google).

The stocks mentioned here are for illustrative purposes only and are not meant to be an investment recommendation.

After decades of observing the global markets and the best investment professionals who spend their lifetime being stewards of capital, we are yet to find an investment process that is right all the time. As we wrote in a previous blog, “It is extremely difficult to do the right thing consistently. It is impossible to consistently do the right thing at the right time.”

Our own investment philosophy of being strategic, global, value and active managers has been tested in this market cycle. We remain long-term strategic investors having invested with some managers and funds for decades though there performance has lagged at times during this period (and other periods before). We remain committed to global investing (with a US bias), while the greatest period of outperformance of the US markets versus the world continues. Growth stocks continue their dominance, while we have been profit takers in this asset class and are over-weighting the value stock asset classes today. In the US equity markets in this market cycle, passive and index investing has in the majority of cases outperformed active management. Yet, we remain committed to our managers and their intellectual capital.

Is our conviction, stubbornness or discipline rooted in a core set of beliefs based on empirical evidence, thoughtful intuition and prudent judgement with some timeless attributes? Extended periods of deviation from the averages will make you question yourself. The markets can be irrational longer than many of us have the patience to endure. Central banks, through interest rates and credit, can extend cycles longer than may be healthy.

Our research and experience has taught us that in the short-term, anything is possible, but in the long-term averages regress to their mean; and economies and markets endure (long-term strategic).

Recognizing the revolution in the expanding global middle class and spread of capitalism, investing in the securities of the best companies across the global investing universe improves our odds of finding the best of the best (global investing).

A bias to investing in companies that are enduring enterprises with capable management that can be bought at reasonable prices has proven to be an excellent way to compound investment return with attention to risk management over the long-term (value investing).

Finally, the markets and the people that make them, can and will act irrationally in the short-term that creates opportunities that others will not recognize. This allows prepared and insightful investors to be opportunistic (active management).

We assure you we will ‘not’ do the right things at the right time all the time. We ‘will’ continue to invest in a disciplined process ingrained with thoughtful attributes that aligns its results with your goals and our goals of being good stewards of your capital.

Views expressed are not necessarily those of Raymond James and are subject to change without notice. Information provided is general in nature, and is not a complete statement of all information necessary for making an investment decision, and is not a recommendation or a solicitation to buy or sell any security. Past performance is not indicative of future results. There is no assurance these trends will continue or that forecasts mentioned will occur. Investing always involves risk and you may incur a profit or loss. No investment strategy can guarantee success.

Insights & Discovery