Written by us and relevant to you, it’s our vehicle for sharing financial insight into current topics about the markets, the economy and the investment world. Please contact us if you would like to be notified of blog updates, have questions, comments or would like to learn more about the information posted here.

“Either write something worth reading or do something worth writing.”

There was a farmer who came home one day to find his horse had wondered away. His neighbours sympathized with him telling him what a bad thing it was that his horse had disappeared. He replied, “Time will tell.”

In a few days his horse reappeared with three other horses. His friends were very happy for him and told him what a stroke of good fortune he had. He replied, “Time will tell.”

A few days later his son was riding one of the horses. He fell off, broke his leg rendering him unable to work the farm. His family and friends bemoaned the farmer’s bad luck. He replied, “Time will tell.”

The following week war broke out and many of the young were drafted into the war. Because his son had broken his leg he was unable to be drafted. His friends and neighbours were happy for the farmer and his family that his son was saved from the war. He replied, “Time will tell.”

The current bull market in stocks began March 9, 2009. Within two weeks of this writing, and without a 20% decline in the major averages, the bull market will be 8 years and 11 months old. It has endured a rising debt bubble in China, global deflationary concerns, Greece’s financial meltdown, the surprising election of Donald Trump, the bombastic first year of Trump’s presidency, nuclear war concerns in N Korea and a ‘no repeat’ from the Chicago Cubs.

The stock market and investing have many risks associated with them. There are too many to highlight for the sake of brevity. However, for the average investor the risk most associated with the stock market, and the one that may affect investor behaviour more than any other, is volatility. Academically speaking, volatility is the dispersion in returns of a market or security. In Laymen’s terms it is the change in value of your monthly statement.

Last year was a magical year for investing; 20+% returns and a whisper of volatility. We have been professionals in the markets since the early 1980’s, and 2017 was the least volatile year for the US stock market in our career. According to Barron’s Magazine February 3, 2018, the S&P 500 completed its 10th straight month of gains in January, the longest winning streak since 11 months ended January 1959.

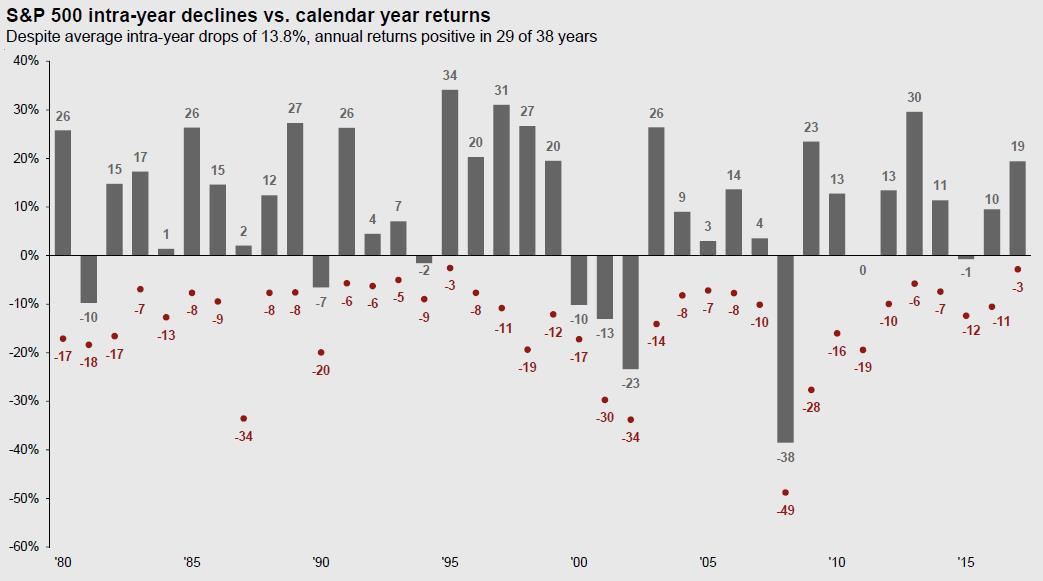

The following chart from JP Morgan’s Guide to the Markets December 31, 2017 highlights that the worst intra-year decline for the S&P 500 last year was only 3%. It was the third lowest intra-year decline in the last 37 years.

Source: FactSet, Standard & Poor’s, J.P. Morgan Asset Management

You can see from the chart that volatility levels like those in 2017 are very rare. They are generally short-lived and followed by much larger spikes in volatility. We are not big on predictions. However, though history rarely repeats, it does often rhyme!

Why does volatility frighten us? And how do we use it to our advantage?

First people are simply emotionally and psychologically affected more by loss than gain; i.e. pain than pleasure. Second people internalize temporary changes (losses) into permanent ones. A common phrase from investors near a market bottom is, “Will this ever end?”

The essence of investing is to buy low (buy the pain) and sell high (sell the pleasure). After years of being investors, we can tell you that this is intellectually easy to accept and emotionally difficult to accept! As in life in general, cycles and change are inevitable. All cycles have highs and lows and beginnings and ends. Embracing change and understanding where we are positioned in a cycle is necessary for long-term success. Ultimately to be a successful investor it requires inverting your emotions and your actions to accept the bad (declines) as buys and the good (gains) as sells.

Losses are permanent because you either invest in something that goes bankrupt or you sell near the bottom of a correction (SELL LOW) and wait too long to reinvest (BUY HIGH). Losing through bankruptcy is the result of concentration, leverage and a poor decision (management) or some combination thereof. It is not part of our investment philosophy or process.

Significant volatility can lead to emotional anxiety that can result in buying high (the fear of missing out) and selling low (the fear of losing). We have witnessed it first hand, in particular selling low, and it can create permanent losses. This is where behavioural management comes into play, and what may be the single most difficult thing in investing.

So how do we use volatility to be constructive and not destructive? There are four things you must have in your belief system and process to use volatility to your advantage. First, you must have an understanding that stocks provide excess returns over the rate of inflation long-term. This helps you accept that volatility (risk) is a characteristic of higher returns.

Second, you must understand yourself as an investor (or in partnership with your advisor) to know your pain tolerance; i.e. how much volatility you can accept. Can my portfolio go down 10%, 15%, 25%, etc. before I may change my behaviour and make poor decisions?

Third, you have to be aware that everything cycles and that the current phase is temporary. Cycles vary in their durations and their highs and lows. But no bull or bear market, recession or growth economy, interest rate cycle, inflationary or deflationary cycle last forever.

Fourth, you must remain optimistic that the global financial markets and economy will remain competitive and self-correcting, innovative and long-term intelligent allocators of capital. Warren Buffet and Charlie Munger, two of the greatest minds and investors of all-time, are 87 and 94 years old, respectively. They have lived through many cycles, many crisis’ and could be negative curmudgeons. Yet they remain curious and optimistic about man’s ability to make the world a better place. We recommend the same.

We started this piece on January 31. As we forward it to compliance on February 6 the market is experiencing volatility of old. The Dow Jones has experience a 4+% or daily correction on the back of a 2+% down day. Bear markets (losses of 20% or more) contain one or more of the following scenarios; over-valuation, a commodity price surge, aggressive monetary policy or a recession. In the near term, over-valuation seems like the only culprit. We would consider this a ‘valuation correction’ at a point where sentiment toward higher interest rates and signs of inflation are at inflection points. How will it progress? Time will tell.

Views expressed are not necessarily those of Raymond James and are subject to change without notice. Information provided is general in nature, and is not a complete statement of all information necessary for making an investment decision, and is not a recommendation or a solicitation to buy or sell any security. Past performance is not indicative of future results. There is no assurance these trends will continue or that forecasts mentioned will occur. Investing always involves risk and you may incur a profit or loss. No investment strategy can guarantee success.

S&P 500 intra-year chart - Returns are based on price index only and do not include dividends. Intra-year drops refer to the largest market drops from a peak to a trough during the year. For illustrative purposes only. Returns shown are calendar year returns from 1980 to 2017, over which time period the average annual return was 8.8%. Guide to the Markets – U.S. Data are as of December 31, 2017

Insights & Discovery