What is familiarity?

It’s the instinct to favor what we know, driving us to be loyal to the things we’re exposed to most. It’s why we repeatedly choose the same routes and restaurants, and why the more we hear a song, say a name or visit a place, the more we tend to like it.

Studies have shown that not only do we favor what we know, we also assign higher value to it. For instance, we tend to find the familiarity of symmetrical features more attractive, intelligent and even trustworthy.

Familiar = flawed?

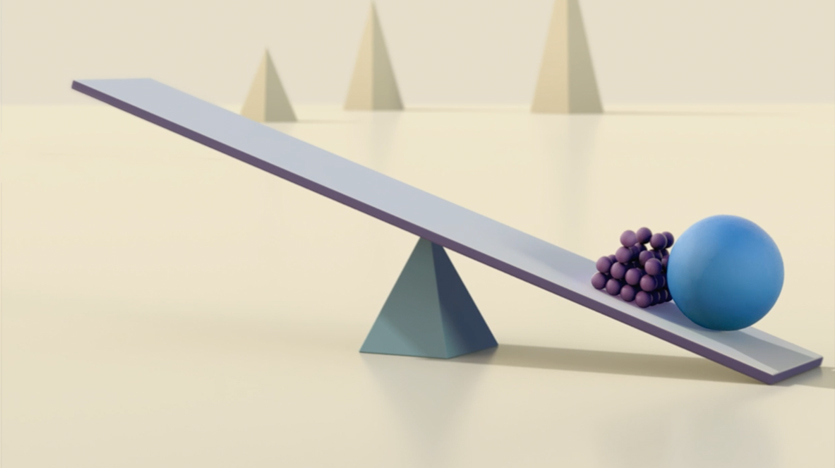

When it comes to financial planning, leaning too heavily on the familiar can lead to an underdiversified portfolio. In some cases, even knowing the bias exists isn’t enough to counteract it. Research from Vanguard found that investors are aware of their own “home bias,” but still actively overweight domestic holdings at the expense of foreign investments in their portfolios.

Familiarity is also a common culprit behind overconcentration. Employees at large companies are regularly overconcentrated in their company’s shares, and it can have dire consequences. In the infamous case of Enron, the collapse of the firm led to the collapse of employees’ retirement plans – 62% of the assets in their 401(k)s were company stock.1

When familiarity factors into your financial decisions, you might:

- Favor domestic securities, well-known companies or companies you’ve worked for.

- Risk losses by concentrating your portfolio in a particular investment, asset class or market segment.

- Neglect to view your portfolio from a strictly risk-reward perspective.

- Avoid unfamiliar planning solutions that could provide a more well-rounded financial plan.

Clinging too tightly to the known can put your financial plan in peril. However, you can take steps to strike the right balance of familiar and fresh.

How you can break out of the familiar

- 1. Don’t let a company’s name or how you feel about its product be the only thing you consider when investing. Look at the security’s underlying characteristics.

- 2. Make sure you include data and objective research in your decision-making rather than relying solely on your gut or “comfort zone.”

- 3. As your financial life becomes more complex and nuanced, consider solutions that fit your evolving needs.

- 4. Look for help. In the case of your financial future, it helps to work with an objective third party – like an experienced financial advisor – who can offer perspective in addition to wealth planning and investment support.

There’s much to be said for the comfort of the familiar, but it’s important to remember that while the unknown can be a risk, the well-known isn’t always the better choice. Learning to resist the lure of the financially familiar can help you broaden your potential.