What is overconfidence?

Overconfidence is our tendency to overestimate what we know or what we’re capable of.

It usually trips us up in small ways, giving us blind spots – like how quickly we can complete a list of chores – but it can also affect us in big ways. For instance, 25% of Americans who are 45 or older are not at all financially prepared for sudden long-term care costs.¹

Overconfidence = underperformance?

When it comes to financial planning, overconfidence creates the illusion that past success was the result of intrinsic skill, leaving little room for the role of external forces or plain luck.

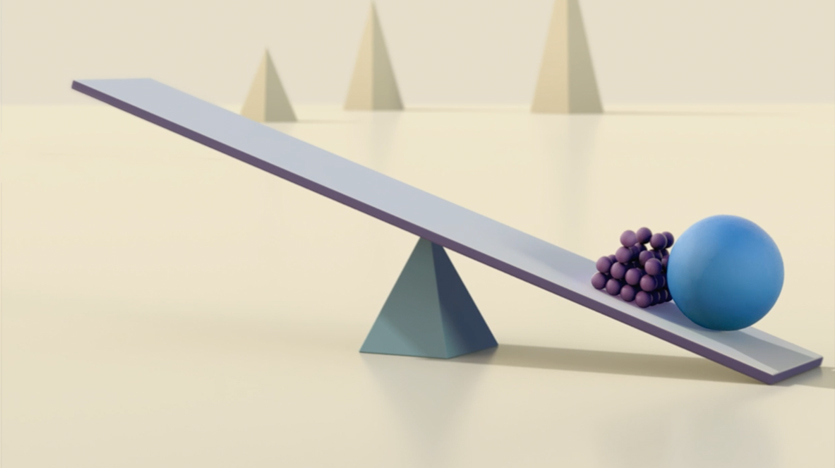

Overconfident investors believe they can time the market, despite the high likelihood of failure. Price movements are notoriously unpredictable, and guessing wrong even a few times can significantly impact returns.

Overconfident investors also believe their success with a particular strategy or investment type can be repeated, leaving them with overconcentrated portfolios when diverse holdings are shown to perform better over time.

When overconfidence creeps into your financial plan, you might:

- Assume past successes were the result of skill alone and are always repeatable.

- Eat away gains with transaction costs and taxes from buying and selling.

- Be underdiversified, focusing primarily on individual stocks or certain kinds of securities.

- Miss or ignore signals and external advice that suggest making a change.

Overconfidence is one of the surest ways to undermine the success of a long-term financial plan. Fortunately, it doesn’t have to be the downfall of yours.

How you can overcome overconfidence

- 1. Take a good look at the fee and tax consequences of your investment activity. Do the gains outweigh those costs on a consistent basis?

- 2. Ensure your long-term plan can handle the unexpected – like a sudden health event, longer-than-predicted retirement or market shifts.

- 3. Consider the real source of your gut feelings. Is your confidence greater than research and evidence?

- 4. Take an objective look at past successes. How often were luck or external factors involved?

- 5. Look for help. In the case of your financial future, it helps to work with an objective third party – like an experienced financial advisor – who can offer perspective in addition to wealth planning and investment support.

While believing you can always beat traffic or the clock is usually harmless, overconfidence can sabotage bigger decisions. Take steps to become just the right amount of confident when it comes to achieving your goals.